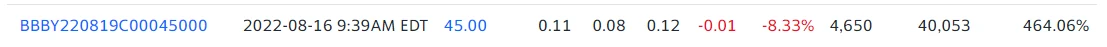

People are only bidding .08 for the option, and people are now asking .11, This was the it will be a dime by Tuesday. This shows no one is thinking $45 by the end of the week. If someone meets in the middle, I was saying this should only be worth about .10 by the end of the day. Now $14 is not a lot of money and neither is $10, but that's a huge drop percentage wise.

Jump in the discussion.

No email address required.

i just sold my profits off the stock this morning to buy a $26 call. Then i come here and see this post. I still have no idea what im doing, but it seems to be going well.

But I think I understand the time decay better now. As the option gets closer to the exp date the price gets more unrealistic and loses value

Jump in the discussion.

No email address required.

Ok right now you are .75 cents from the strike. BUT you see that break even price? that's the amount the shares have to reach for you to be even if you will buy them in the end. That is share price plus what you paid for the contract becomes the break even price for example, if the stock is $27 on next Friday, you over payed for the stock even with the $26 strike.... always factor in your costs. You are up $200 on the contract right now, You need to have a plan to either get out and sell the contract or purchase the shares. I would know this answer by the end of the week because decay will speed up on you next Monday.

I don't use RH so it would be in your best interest to youtube.

How to close out an options contract. We call it buy to close. but the reality is you are selling that contract to someone else. Don't let the verbiage confuse you. But you need to watch a tutorial on how to do it so you can get out as soon as it's time.

Or if you want to buy the 100 shares. You need to one have the money in your account. (DO NOT USE MARGIN ON A MEME STOCK) and watch a tutorial on how to "Execute" a call option. But have cash on hand, or put it in soon, most brokers unless you have all your accounts with them take three business days for the money to clear.

I use the think or swim platform and it's like flying a space ship compared to RH, so you using RH is the only thing I can't help you with. But I will keep an eye on the contract with you. But I wont choose what you should do with the profits or losses. I will tell you how much you stand to make with choice A or B but what you do with your money is totally up to you.

Just FYI the you can sell that contract for $700 right now, to the fucking moon you did great.

Jump in the discussion.

No email address required.

I think peak hype will be on Thursday and i will probably sell then unless the hype turns into a media circus that attracts more normies for next week like with GME. thanks for the heads up on how to sell, i was thinking it was as easy as selling regular stock, so ill definitely check some videos tonight

Jump in the discussion.

No email address required.

On RH it may be easy. It is easy on TOS, but no two platforms work the same.

Jump in the discussion.

No email address required.

More options

More options

More options

How does one micro-manage perception of trends in the company without investigation?

Jump in the discussion.

No email address required.

Heres the secret on how i make money in stonks and crypto:

I go to 4chan and if I see a funny pepe, i invest. However, you must develop a strong ability to detect pajeet scammers and chinese bots. That can only come from experience.

Jump in the discussion.

No email address required.

Yeah i was thinking thts why forums are useful.

Jump in the discussion.

No email address required.

They are the least useful thing to use for any sort of long term portfolio. There are two ways to invest, Technically using charts. And Fundamentally reading through the boring K-2's and other really boring corporate forms companies are required to publish. I feel understanding and utilizing both are extremely important. And Educating yourself on both styles will give you, not an edge. But it would give you a higher chance of making informed decisions on what you would like in your portfolio. It's extremely important to fully understand how the company makes their money before you invest, you need to know everything about where you money is going. Ready I'll blow your mind right now.

I have a sizable position In Mc Donalds. Do you think I give a fuck about how many hamburgers they sell every year? Or if their food sales are down or up for the the quarter? Slightly. I invest in that company because they own the commercial properties on most main roads and highways of America. Every time you see a McDonalds, I own a piece of that giant commercial real estate portfolio. So I care more about interest rates, and the commercial real estate numbers than how many Chicken Mc Nuggets get sold. So they own most physical locations and they collect a ton of absurd fees from the franchise owner. They franchise goes belly up they sell the location not the property to another person, or they just resell the property if it's not profitable to sell burgers in.

Next time you pass or eat at Mc Donald's say to yourself, Obese owns 1/64 of every toilet mint I piss on.

Jump in the discussion.

No email address required.

Hmmm. Thats pretty interesting. You can reduce the analysis to brass tactics with simpler business models and see profit. That does simplify in the narrowing down step for long term. Thank you.

Jump in the discussion.

No email address required.

The only way and this was something I was going to go in to detail with was. Ever hear the term what is your five year goal? I only invest in things I feel (knowing is impossible) that will be around and thriving five years from now. I only gamble with a very small % of my portfolio and take very small profits on them before they turn against me. One share of company X that is selling for $100 right now, is way cheaper than 10 shares of company Y selling for $10 a share. It's less expensive per share but who is the proven company? That's how you have to start your portfolio. This is not a recommendation. But Amazon is cheap as fuck right now, reason why. They have almost no chance of going tits up in the next 5-10 years, I can rattle off 100's of companies for $10 a share that wont make it 2 years. What's the safer play for your money. And you have to think outside the box it's better to stay in a sector, I will use airlines. I went balls deep on the Covid crash, why, simply 5-10 years from now Covid will be a thing of the past, then I will make 5-8x on my money. I don't look at the news or earnings on the companies right now, they are burning cash. But I think outside the box, I check the TSA sit to see how many people are going through the gates to see if more people are flying month to month.

Jump in the discussion.

No email address required.

Going in on that covid crash seems like a once in a lifetime opportunity to get into and expensive stock market for cheap with the gamble of survivability. Gratz. Yeah, I want to enter the investing scene similarly. Hopefully, start a retirement fund early.

Jump in the discussion.

No email address required.

More options

More options

More options

More options

to be less sarcastic, i usually skim through threads once a day or so and get a jist of what people are talking about. I saw BBBY mentioned a couple times prior, then one day i saw that there was its own general thread in /biz/ and people were actually discussing it. Then i went to WSB and saw a post about it there. After reading the conversations more in depth I decided it had solid meme magik potential and made what I consider a very small investment into it.

Jump in the discussion.

No email address required.

Are We Rich Now Son?

Jump in the discussion.

No email address required.

More options

More options

More options

More options

More options

More options

It’s alright to be better than people.. I deal with that on a constant.

Snapshots:

archive.org

archive.ph (click to archive)

ghostarchive.org (click to archive)

Jump in the discussion.

No email address required.

More options